Clarity is still possible when security isn&#

A school needed money for urgent repairs, but they coul...

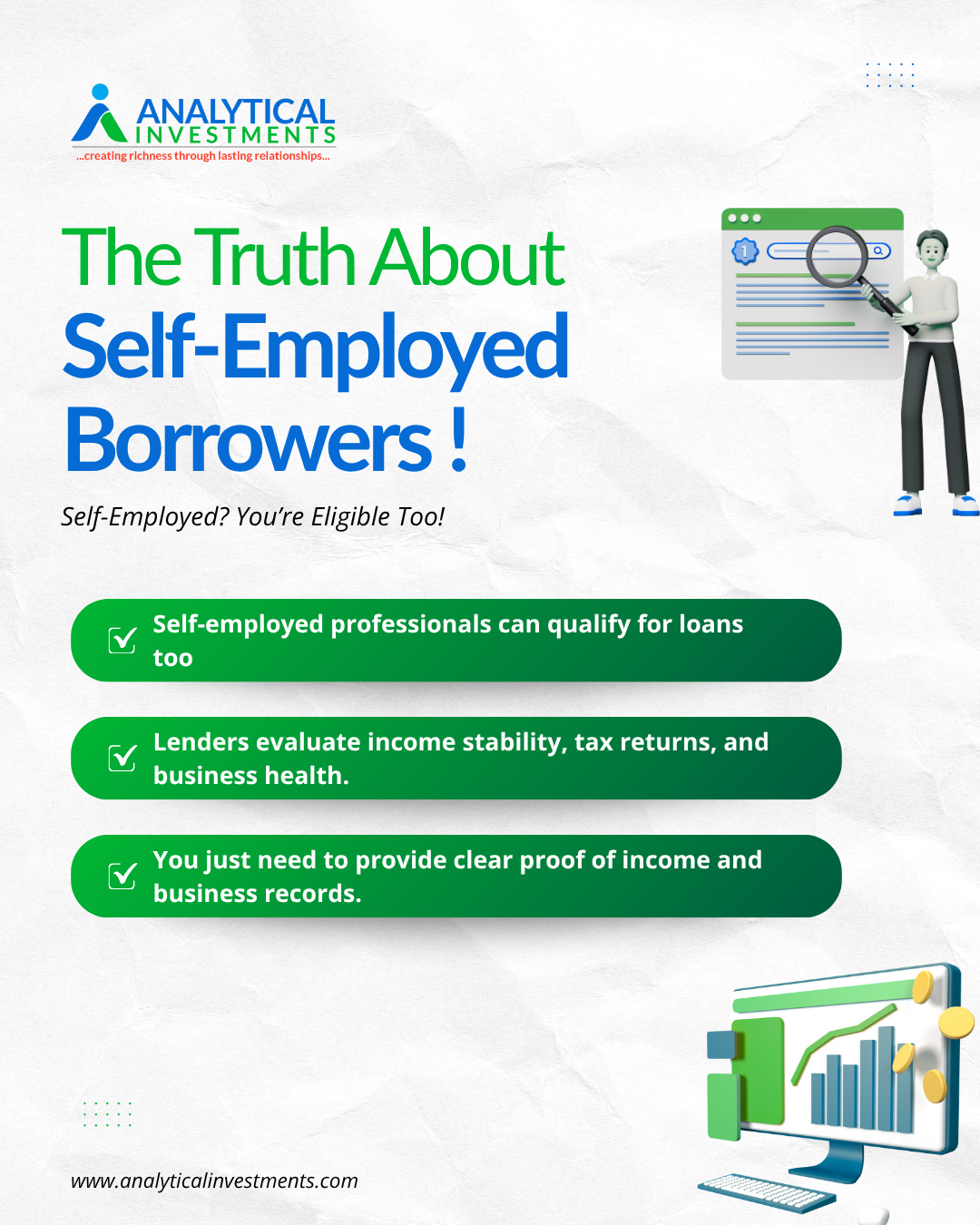

Think being self-employed disqualifies you from getting a loan? Think again. 💼💸 The idea that only salaried employees can secure loans is a myth that’s long overdue for debunking.

As a self-employed professional, you have unique advantages that can make you a strong candidate for loans. With the right financial documents, such as tax returns, business records, and proof of income, lenders assess your financial health, not your employment type. The more organized and consistent your financial records are, the higher your chances of approval.

So, don’t let outdated myths hold you back. Whether you’re looking to expand your business, refinance debt, or take on new projects, there are loan options tailored for self-employed individuals. It’s all about showing that your business is stable, and your financial health is solid. Ready to make your entrepreneurial dreams a reality? 🚀

A school needed money for urgent repairs, but they coul...

One of a devoted businessman's three mortgaged properti...