Your product leaves your hands. Responsibilit

I often see businesses believe risk ends once a product...

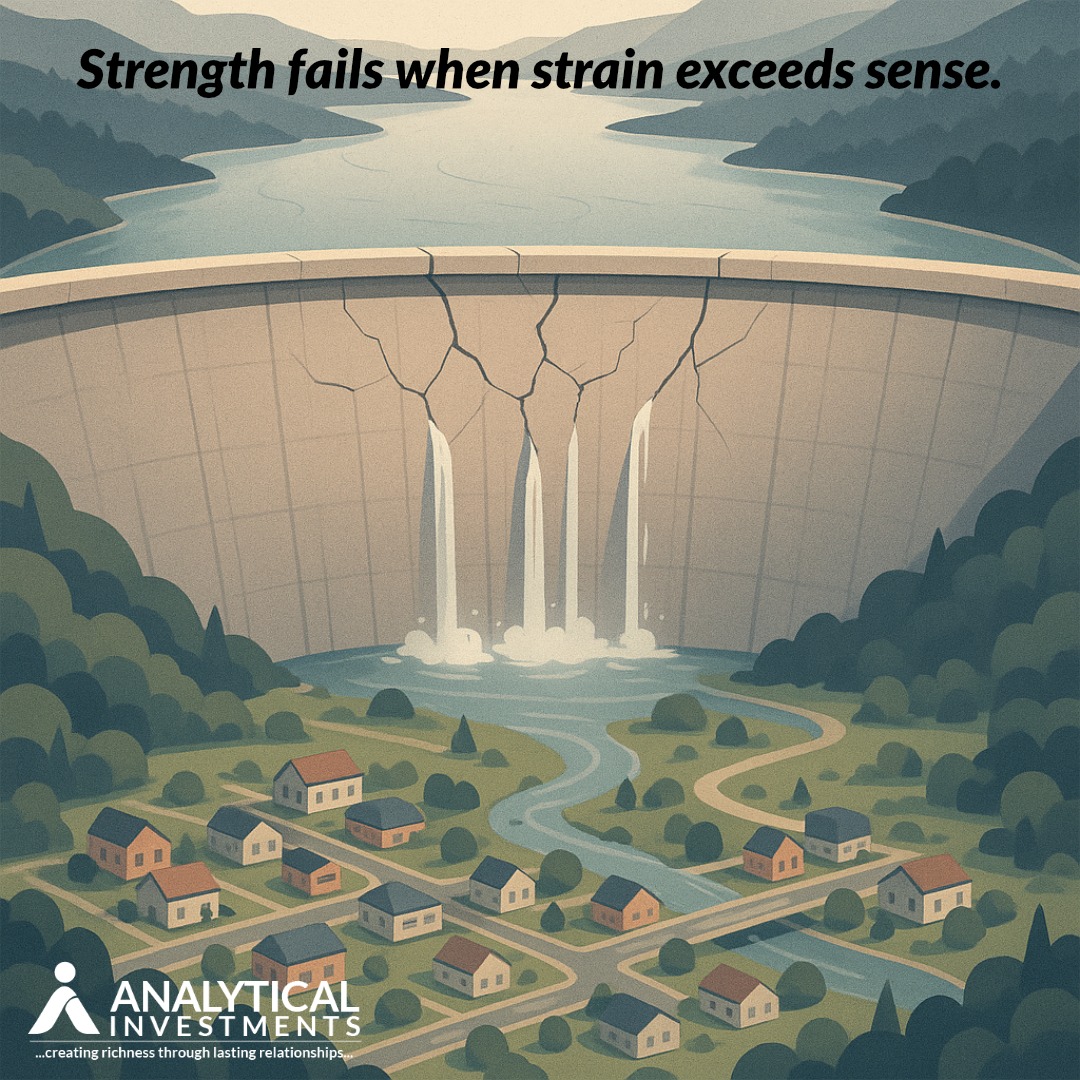

Most businesses don’t get into trouble because they borrowed.

They struggle because they over-leveraged without the margins to support that borrowing.

Here’s the tipping point:

👉 When margins can’t comfortably absorb the cost of borrowing

👉 When every month becomes a balancing act between EMIs and operations

👉 When cash flow becomes tight enough that strategic decisions get delayed

👉 When growth opportunities are avoided because the business is already stretched

At that moment, debt shifts from being a growth accelerator to becoming a silent decelerator.

Healthy leverage gives you speed.

Over-leverage takes away your freedom.

The goal isn’t to avoid debt it’s to use it with intention, strategy, and a clear understanding of margin safety.

If you or your friends want to evaluate whether your current debt structure is helping or hurting future growth, I’m always happy to discuss it.

I often see businesses believe risk ends once a product...

t’s because timing, flexibility, and practicality mat...