Most businesses insure assets before they ins

I often see organisations protecting property, equipmen...

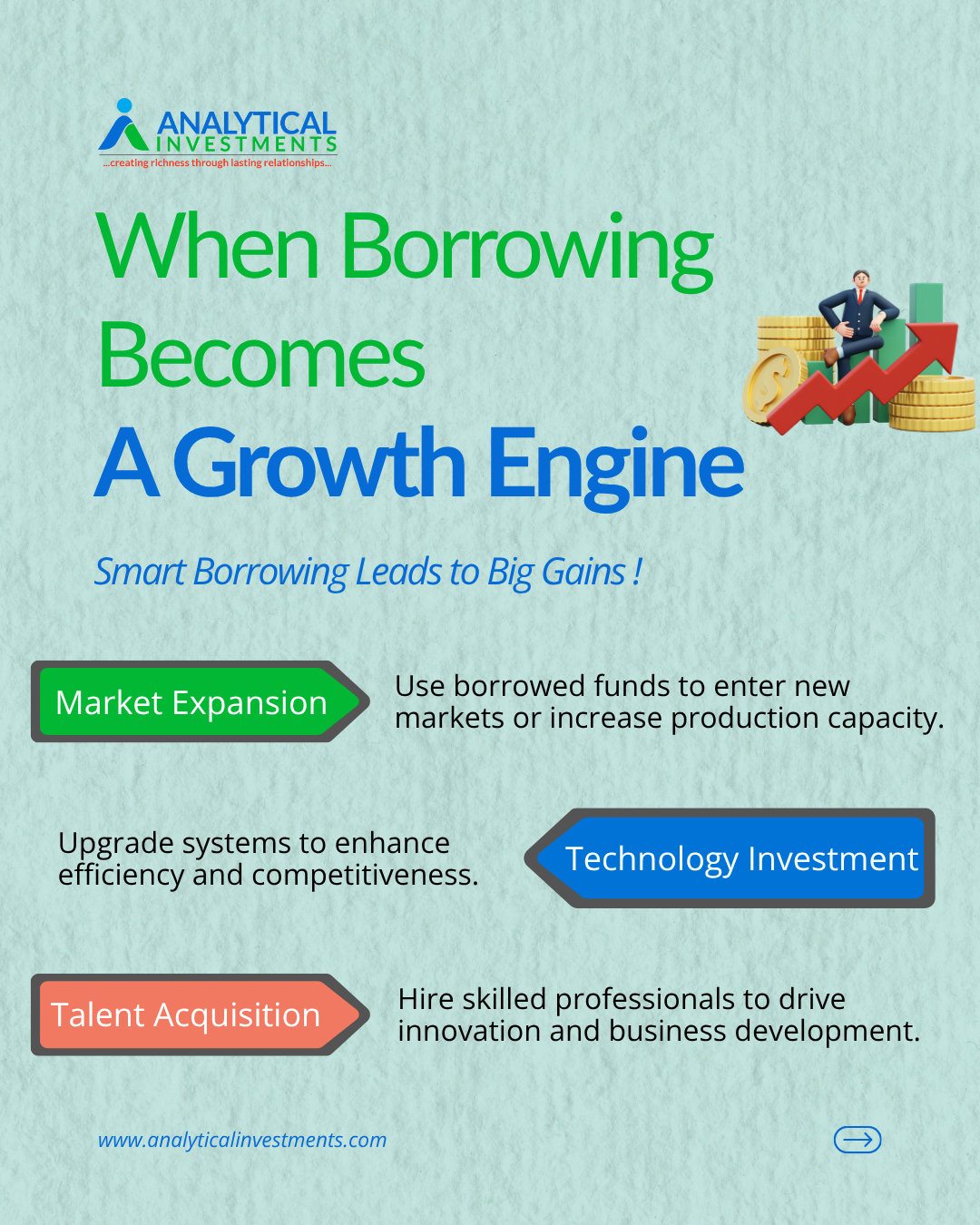

What if “debt” isn’t a burden, but the hidden engine behind breakout growth?

Smart founders don’t fear borrowing; they use it to scale faster without giving up control.

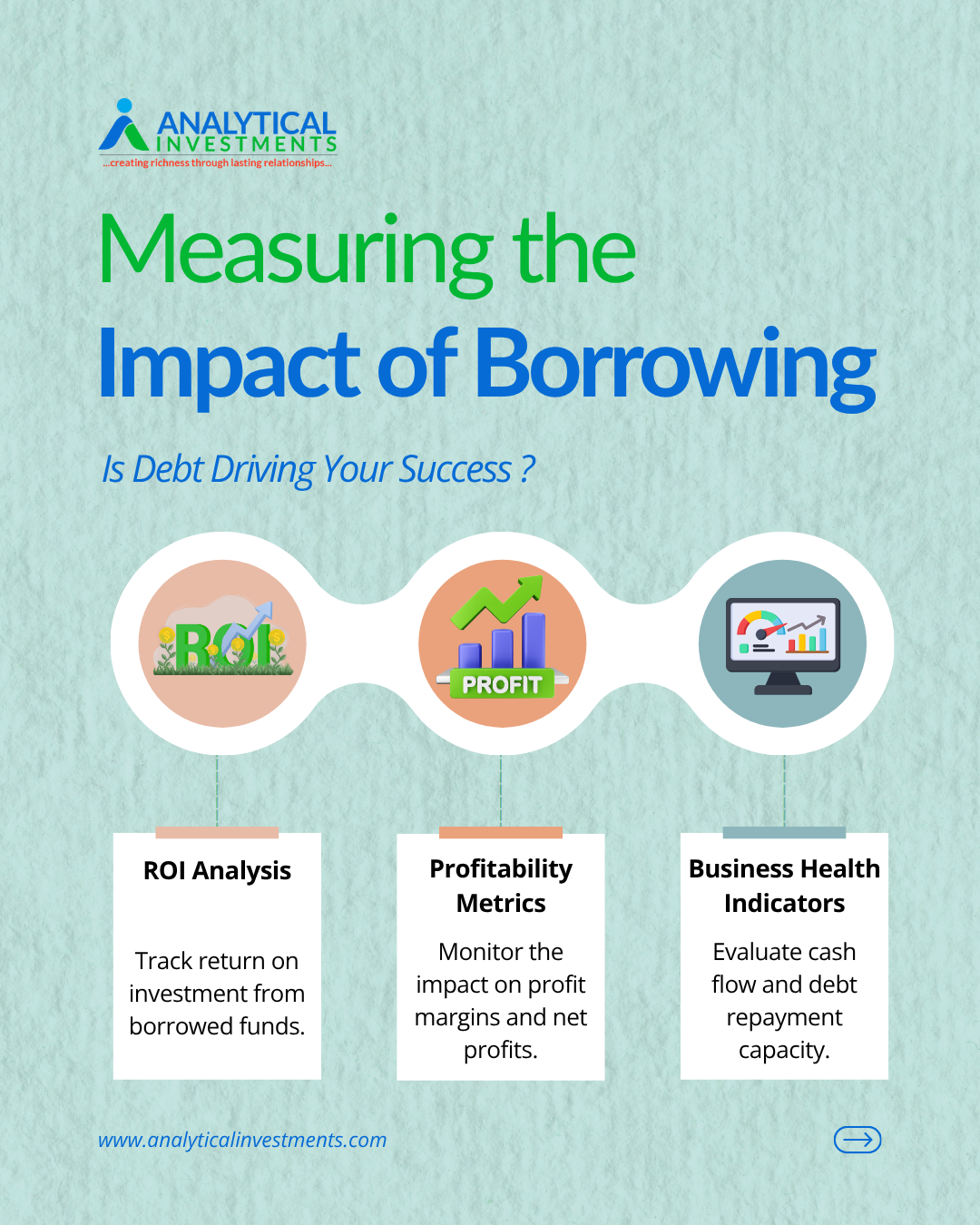

When used intentionally, debt unlocks quick capital for market expansion, tech upgrades, and top-tier talent, while equity stays yours. The secret is discipline: borrow against clear ROI, monitor cash flow like a hawk, and keep a healthy debt-to-equity so every borrowed rupee works harder than the last.

Curious what “smart borrowing” looks like for your business? Let’s map a debt strategy that fuels growth, protects ownership, and pays for itself. Scan the QR to start.

I often see organisations protecting property, equipmen...

An established textile retailer had a difficult time du...